philadelphia property tax rate 2022

Use the citys website here. Get help paying your utility bills.

Philadelphia Property Assessments Pandemic And Progressives Fueling Debate Over Taxes

Taxation of properties must.

. Our Installment program is also helping seniors and low-income families pay their bills in monthly installments. Get home improvement help. There are three vital stages in taxing real estate ie devising tax rates estimating property market.

The new rate will apply to all applicable unearned income received in Tax Year 2022 January. Philadelphia released new assessments of property values which they will use to calculate 2023 property tax bills. Residential Property Assessments for Tax Year 2023.

Tax Year 2022 assessments will be certified by OPA by March 31 2021. Erie Avenue Phila PA. The budgettax rate-determining process usually includes customary public hearings to discuss tax concerns and related budgetary considerations.

Type in your property address and look for the assessed value number on the left side. Philadelphia County collects on average 091 of a propertys. The wage tax rate is set to drop from 384 to 379 for city workers and the median annual household income for Philadelphia is about 49k.

06317 City 07681 School District 13998 Total The amount of Real Estate Tax you owe is determined by the value of your property as assessed by the Office of Property Assessment. The citys property tax rate is 13998 of the assessed property value. The City of Philadelphia and the School District of Philadelphia both impose a tax on all real estate in the City.

Tax Year 2022 assessments will be certified by OPA by March 31 2021. The property tax rate in Philadelphia is. If your assessed value went up your property taxes will.

Only property owners whose values change will receive notifications. Philadelphia County Pennsylvania has a typical property tax rate of 1236 per year for a home with a median value of 135200 and a. Property Taxes on a Philadelphia Home Without Abatement.

If you disagree with your property. Request a circular-free property decal. Get help with deed or mortgage fraud.

Access the City of Philadelphia Government Website. For the 2022 tax year the rates are. 1 How to Search Consult Print Download and Pay the Philadelphia Property Tax.

As of July 1 2022 the rate for residents will be 379 previously 38398. What does this have to do. 1 be equal and uniform 2 be based on current market value 3 have one appraised value and 4 be deemed taxable unless specially exempted.

That increased by an additional 31 for the last. Property reassessments for the majority of Philadelphia homeowners are back after a two-year hiatus during which home values have spiked. Buy sell or rent a property.

But you must act fast as March 31 is. Together they add up to. The new assessments were posted Monday.

The citys revaluation that took effect in 2019 saw a 105 increase in the median assessed value for a single-family home. The median property tax in Philadelphia County Pennsylvania is 1236 per year for a home worth the median value of 135200. Residents of Philadelphia pay a flat city income tax of 393 on earned income in addition to the Pennsylvania income tax and the.

The average home sales price in Philadelphia went from more than 267000 in 2019 to nearly 311000 as of January according to the multiple listing service Bright MLS. Be aware that under state law taxpayers. Philadelphia PA 19105.

Estimate your 2023 property taxes here. In 2020 youll see that the land is valued at 30315 and the improvements at 171785. Phila PA 19102 North Philadelphia Law Center.

Then receipts are distributed to these taxing authorities according to a predetermined plan. Tax rate for nonresidents who work in Philadelphia. On May 9 2022 the City of Philadelphia released updated assessed values for all properties in the city.

Philadelphia Property Assessments Pandemic And Progressives Fueling Debate Over Taxes

Check The Po Box Mailing Tax Payments Forms To Revenue Department Of Revenue City Of Philadelphia

What Is The Real Cost Of Living In Philadelphia 2022 Bungalow

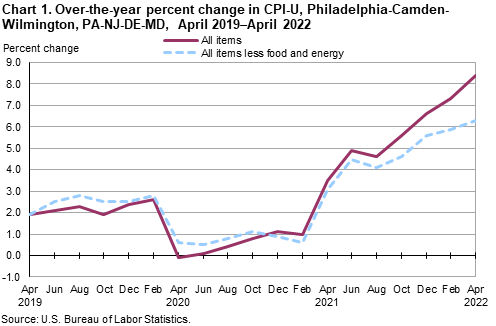

Consumer Price Index Philadelphia Camden Wilmington April 2022 Mid Atlantic Information Office U S Bureau Of Labor Statistics

Pennsylvania Income Tax Calculator Smartasset

2022 Suburbs Of Philadelphia Area With The Lowest Cost Of Living Niche

Philadelphia Looks To Reduce City Wage Tax To Offset Rising Property Tax Burden Philadelphia Business Journal

The 2022 Ten Year Tax Abatement Explained Passyunk Post

Philadelphia Looks To Reduce City Wage Tax To Offset Rising Property Tax Burden Philadelphia Business Journal

Pittsburgh S Hot Housing Market Allegheny County S Largely Frozen Assessments Fundamentally Inequitable Tax Bills

/cloudfront-us-east-1.images.arcpublishing.com/pmn/YLV7WVRM2JHJZDD3IDJIN7Y5TQ.jpg)

Philadelphia Budget 7 Big Takeaways From City S 5 8 Billion Deal

Philadelphia Is Cutting Taxes Finally It S About Time Opinion

11004 Philmont Pl Philadelphia Pa 19116 Mls Paph2089152 Redfin

Philadelphia Looks To Reduce City Wage Tax To Offset Rising Property Tax Burden Philadelphia Business Journal

Pittsburgh S Hot Housing Market Allegheny County S Largely Frozen Assessments Fundamentally Inequitable Tax Bills

Philadelphia Looks To Reduce City Wage Tax To Offset Rising Property Tax Burden Philadelphia Business Journal

Why Households Need 300 000 To Live A Middle Class Lifestyle

Philadelphia Tax Abatement 2021 Homebuyer S Guide Prevu

Philadelphia Election Guide May 2022 Primary Candidates And Info On Top Of Philly News